The power of the peacock logo goes from Paris to São Paulo.

NBCUniversal’s grip on the American sports viewer will be tightened during the first weekend of the 2024 NFL regular season with three games in four nights on their properties, including its streaming arm, Peacock.

“They’re using sports as a key part of their identity for Peacock,” media analyst John Kosner told USA TODAY Sports.

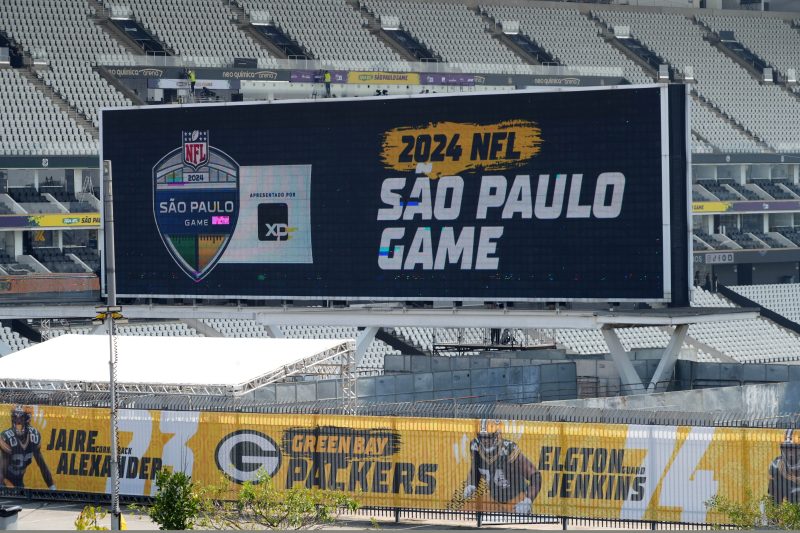

Following the season opener between the Kansas City Chiefs and Baltimore Ravens on NBC, the Brazilian matchup between the Green Bay Packers and Philadelphia Eagles will air exclusively on Peacock. The weekend ends with the Los Angeles Rams facing the Detroit Lions on NBC for “Sunday Night Football.”

“So I think they can maintain the momentum,” Kosner said, “and it’s probably part of the plan for the NFL.”

PLAY TO WIN $5K: USA TODAY’s Pro Football Survivor Pool is free to enter. Sign up now!

What the return of investment is for Peacock and other streamers remains unclear, according to fellow streaming analyst Dan Rayburn, who contended that the NFL’s motivations hurt the average fan who wants to enjoy games with ease.

“The NFL is more fragmented than anybody else out there from a sports league standpoint, and obviously the reason for that is money,” Rayburn told USA TODAY Sports. “That’s all it is.”

Peacock paid a reported $110 million for last season’s wild-card playoff game between the Kansas City Chiefs and Miami Dolphins. This year, that exclusive postseason streaming slot was awarded to Prime Video for $120 million. Netflix paid a reported $150 million for a pair of Christmas Day games, which this year will land on a Wednesday.

“The NFL is the most popular content on television in our country, so it’s clearly worth the investment,” Kosner said.

The NFL accounted for 93 of the top 100 broadcasts in the United States last year in terms of ratings, according to Nielsen. Of the major streaming companies in the U.S., only Apple currently does not have NFL rights; Netflix and Amazon are bought in, while Disney, Paramount and NBCUniversal have streaming services as part of their conglomerates.

A popular talking point for the NFL in the streaming shift is that the medium appeals to a younger audience. Other than Amazon and Nielsen for “Thursday Night Football,” companies rarely publish stats regarding demographic data.

“Fifteen-year-olds have no money,” Rayburn said.

Another argument the league makes for putting games exclusively on streaming is that the matchups are available in the local market on traditional network TV. That strategy ignores the fan who grew up rooting for one team and moved to a different market but doesn’t want to have to pay to watch his or her team.

“The NFL doesn’t care about fans. The NFL cares about making the most money possible,” Rayburn said. “And hey, there’s nothing wrong with that, because you’re a sports league and your job is to get paid for your content. But at some point, you have to realize fans are only willing to jump through so many hoops to get what they want from a sports standpoint.”

Beware the churn?

During the Olympics, every event was available to be streamed live on Peacock. NBC created “Gold Zone,” a play on the NFL’s famous “RedZone” setup, for events occurring simultaneously and even hired Scott Hanson to anchor the program.

Peacock reported a loss of 500,000 subscribers in the second business quarter of 2024 and any gains during the Olympics. Matt Strauss, NBCU’s chairman of direct-to-consumer who oversees Peacock, told Rayburn the company doesn’t see its streamer as a quarter-to-quarter business.

“This is a long-term strategy, where Peacock is part of a larger video strategy for them,” Rayburn said.

“If they lose half of them next quarter, who cares?” he added.

Churn is nonetheless a concern, which is why entities like Peacock crave year-round content, Kosner said. That’s why NBCU invested in the latest NBA media rights deal. People need reasons to keep their subscriptions. Sports interests are typically long-lasting.

Although companies such as Antenna claim to accurately track streaming service sign-ups and other consumer data, Rayburn says there is no proof of long-term, sign-up success. Antenna claimed that Peacock picked up 3 million sign-ups leading up to and including the day of the wild-card game – more than the first week of the Olympics, according to IndieWire.

Companies rarely publish data referring to streaming data aside from how it added to the overall number. Mobile viewership is rarely revealed. Average viewing time is never included in viewership press releases, and there is no distinction of unique viewership. Tech issues are also cast aside.

“We have absolutely zero business metrics to measure what the impact is to these streaming services from licensing NFL content,” Rayburn said. “We get the impact on the NFL. They’re making a boatload of money.”

Executives say things like they are “highly pleased” or that viewership “exceeded expectations,” Rayburn said. Kosner noted Peacock personnel talks up the number of subscribers the company has and the viewership number from the playoff game last year. More advertising will come to streaming in the near future, Kosner added.

That’s not good enough for Rayburn.

“Give me numbers,” he said.

Ratings reminders

Thanks to some Taylor Swift mania, the Chiefs-Dolphins playoff game averaged 23 million viewers to become the most live-streamed event in U.S. history.

Don’t expect any record-setting marks this time.

For one, this is Week 1 and not the postseason. Kosner said the Packers and Eagles are both top-10 ratings earners for the league, but he didn’t want to speculate on a potential viewership number given the number of external factors that may impact the ability to watch this matchup.

The Friday after Labor Day still technically qualifies as a “summer Friday.” There is high school football in many parts of the country. And much of Europe will be asleep with the 8:15 p.m. ET kickoff.